One of the most basic but effective levers in advanced Google Shopping optimization is to categorize your products. I don’t mean the product types, the niche or the Google product category, but a data-driven approach.

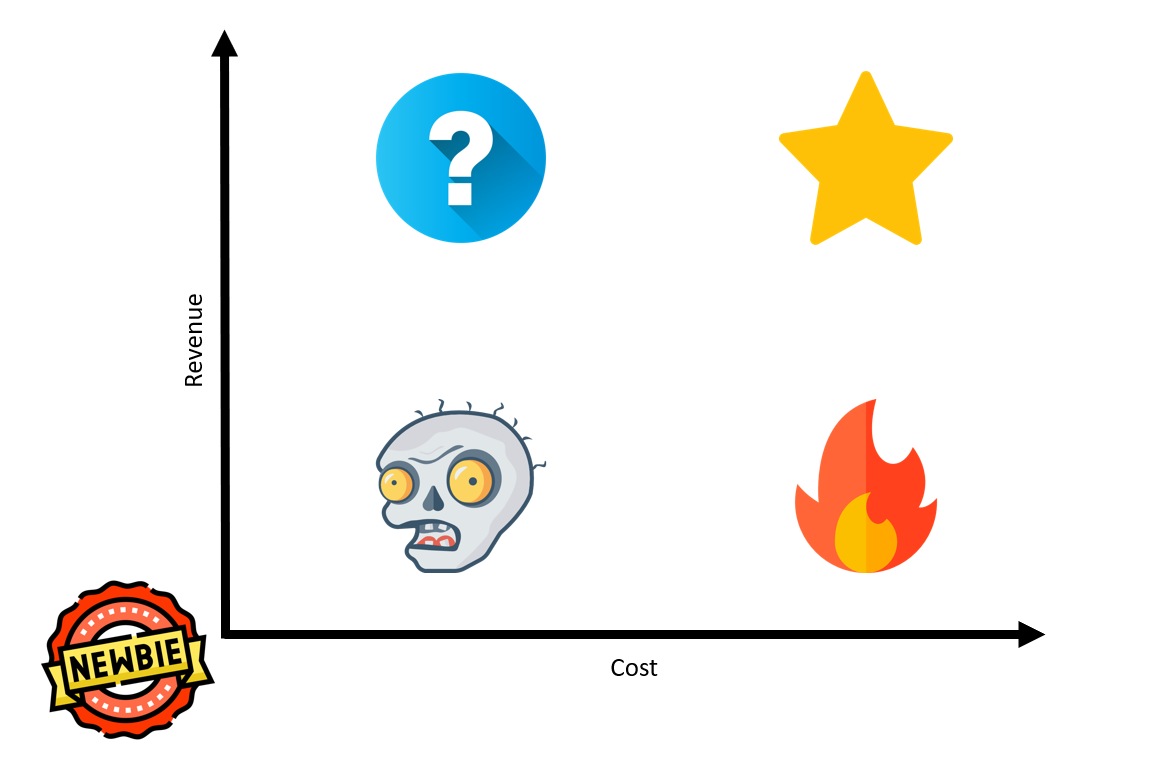

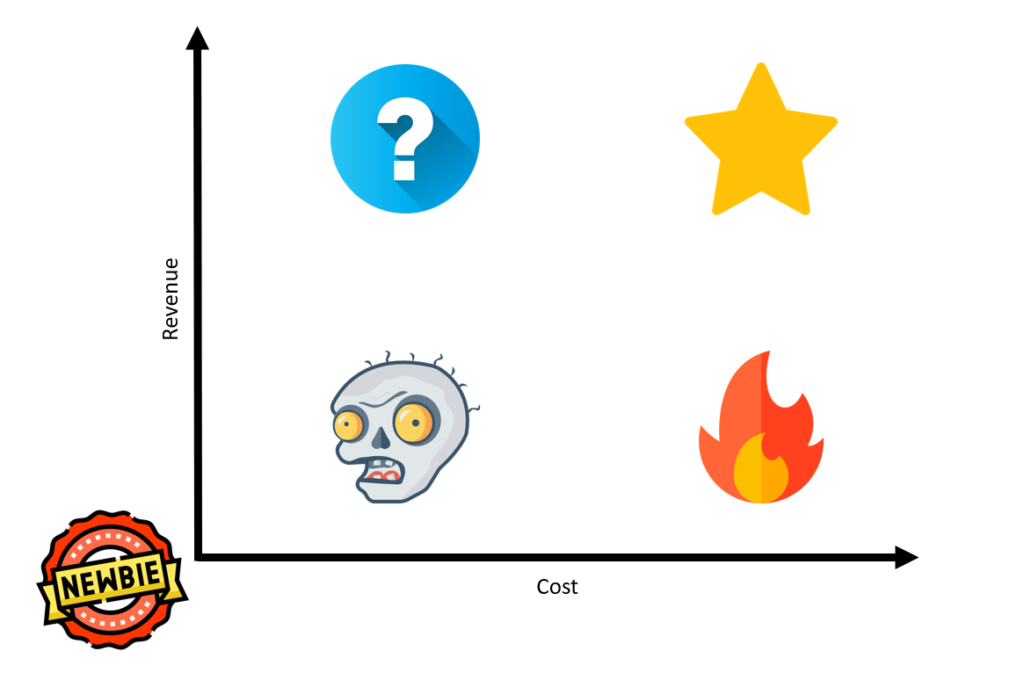

The four-field matrix, aka BCG matrix, most still know from their studies or the classic business books. Boring and out of date? Let’s see and apply the scheme to Google Shopping!

What are data-driven product categories?

- Star products: Typically 20% of items account for 80% of sales. Similar to the Pareto Principle, a small part provides for the largest part of the result.

- Zombie Products: Partially also classified under the term low-volume SKU, there is often a large portion of products that receive little to no clicks or, in the worst case, not even impressions.

- Money burners: The villains among the products, provide despite traffic and high budget input for losses, because no significant revenue is generated.

- Question marks: Our last category is the question marks. We generate sales, but do not have sufficient market share. Can we scale here or are we already at the limit? This is the crucial question for the question mark category.

BCG Matrix complete? Let’s include one more special category.

Newbie products: This usually includes new products that do not yet have data or history and need to be tested. As a rule, there are no performance targets for these products, but the focus should be on obtaining a valid data basis for the newcomers as quickly as possible.

How to optimize Google Shopping topsellers

Regularly check the allocated campaign budget and the actual advertising spend. Google’s budget restriction notifications are often delayed, you may miss out on a lot of revenue. Therefore check the spend frequently or track it on a daily basis with datastudio or google sheets.

Star products can be concentrated in a separate campaign if the products match each other. This bundles data, which benefits the algorithm.

Make sure to monitor the merchant center frequently to avoid suspended star products.

Last but not least, compare your star products offer vs. your competition. Your star products already have traffic, so its up to pricing, reviews, main image and shipping to make a difference in google shopping.

Discover hidden champions with zombie products

The biggest challenge should be tackled first. Find out why the products hardly generate any traffic.

Reasons are most of the time low search volume, very niche products, bad product titles and feed quality, bids too low.

In order to push for more traffic you can enrich those product titles with fitting generic terms. Also make sure to include the brand in the product title, as well as making sure the GTIN is set and the google product category is provided.

Put zombie products in a seperate campaign. You can do this with custom labels and tools like a feed management software, or if you like more automation with supermetrics and google scripts. Once you’ve created a dedicated campaign, push those products with high bids or low roas settings and get data.

Finally analyze the data. Some products might show potential now, others will be money burners and some will stay zombie products. You can’t convert all zombie products into new champions, but we’re here for a few more % of stars.

Cut losses and save money! Watch your money burners.

The easy way aka the fire extinguisher is to exclude those products. You exclude them in the feed export at your backend, in your datafeed management application, or in your campaigns.

Altough its tempting to just exclude your money burners, its recommended to find out, why they cost you money and wont convert.

If a product costs you money, its often searched and clicked in google shopping. Basically that means, that your offer looks attraktive to a potential consumer and there is a market demand for it.

Run some numbers. Look at the paid click prices, your revenues on those products and margins. In some cases, it is just too expensive to advertise a product.

Another point can be, that shipping costs, times or the checkout flow is not good enough, so people click because their interested, but don’t buy.

Some people click on the ad to compare multiple offers. If you can’t provide enough value, customers will decide against you.

Try to improve the average order volume (AOV), with up-sells and cross-sells. You can also try to sell items in bulk packages or multipacks (if applicable).

Analyze the user flow in Google Analytics (or any other analytics solution of your choice). What do people do after they’ve click on your money burners. Do they jump off? Do they look for alternatives in your shop or try to get onto something specific?

Aim for growth with question mark products

First of all check why you’re lacking market share. It might be because of ad budget, traffic, search volume, strong competition and other factors.

Your products might lack market share, because they don’t have enough budget. Maybe

your star products are using too much of the campaign budget and there is little room left for your question marks. You can give them some room in an extra campaign and test how they work out with a dedicated budget.

Your question marks need more traffic. Do they rank well enough (budget, bids, feed optimization), is the offer attractive and do you stand out against the competion?

If the search volume is low, there is usually little you can do. In certain niches there is only little traffic and you can only try to improve your listings with the addition of some generic terms or fitting niche terms in the product feed.

You want to scale your question marks, but if some of them can’t be scaled it’s no issue. Question marks still make some profit for your and as long as they are no money burners you can work with them.

Push your newbie products

You want data for google shopping. If you know there is high demand, get your new launched products into your existing campaigns, if you have no idea at all, create a special push campaign and advertise them with low ROAS settings to get as much data as possible in little time.

Give your newbie products a time frame, for example 30 days. After 30 days you analyze the data and re-segment your new products accordingly.

Don’t focus on profitability with this product category, focus on getting data fast.